Hidden

Costs of Housing

TOM BENDER

RAIN Magazine, March 1984

Tom Bender's offhand mention in our November

1983 issue that we could reduce housing costs by 90% raised many eyebrows.

Possible? A pipe dream? We asked for more details, which follow. We learned

also that these ideas had already won a $15,000 top award in California's

Affordable Housing Competition two years ago.

Let's get some action on this, and more of this kind of rethinking of how

we do things! -TK

Most home purchases are financed. Yet few

buyers could tell you what their total purchase cost will be by the time

their house is paid for. They don't know because they don't want

to face the fact that they may have to spend all their next 10 years' income

just to pay the finance charges.

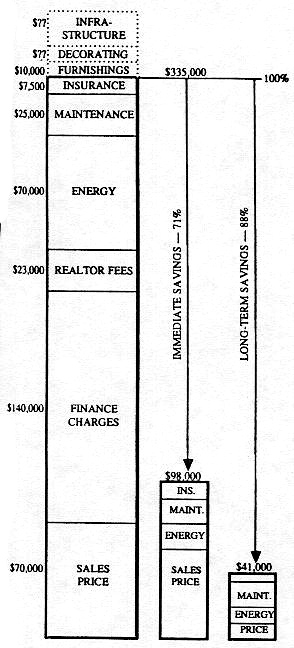

What makes up our housing expenditures? Let's look first at the financial

costs that add up over a person's 50 year "housing lifetime" with

our present patterns (see Figure 1). These costs add up to quite a bundle

out of our pockets, and the labor and materials cost of constructing the

house is only a small piece of the overall cost. As we look at the separate

categories of expenditures, we need to make a distinction between economic

and financial costs, realize the pivotal role that durability plays in housing

"costs," and see how housing scarcity masks a basic cost difference

between new and used housing.

ECONOMIC VS. MONETARY COSTS

Making a distinction between the economic and monetary dimensions of housing

is essential to seeing how decisions affecting the flow of work and money

have interacted to build up today's excessive costs. The economic cost of

a house consists of the work, materials, energy, and land employed in its

construction. Once the house is built, that economic cost has been fully

paid. If built correctly, the house has no further economic cost to its

next several centuries of users, except for maintenance and operation.

The economic costs deal with all the real, objective, and physical

costs of a project - no matter who incurs them. By contrast, monetary costs

stem from the rules a society sets up for distributing the benefits of economic

work. Interest rates, tax laws, loan maturities, government subsidies, and

the prices that different trades and professions can convince others their

time is worth all alter monetary costs. As a result, they alter the final

price that must be paid for economic work, who has to pay it, and who profits

from it.

Monetary structures often obscure the real economic work and come to seem

like some immutable natural law. In reality, they are constantly changing

public policies that help shape the nature of a society - the equality or

inequality of wealth, the concentration of economic and political power,

and the ends to which society puts its efforts. They can, and frequently

do, add a great burden on top of economic costs. Only by separating out

the underlying real economics can we see the true effect of each policy

affecting housing and understand how to alter such effects.

DURABILITY

Once we can penetrate the barrier that financial thinking has put between

us and understanding economic costs, we can examine the actual productivity

of our various housing expenditures. Construction costs, for example, are

largely unavoidable economic costs, and they appear irreducible. But what

is important is not just the cost, but the number of years of housing we

get from that cost. The longer a building lasts, the smaller are the economic

costs per year or per generation. Durability of construction is the key

to economic productivity of housing.

Houses built to last 400 or 500 years can shelter 15 or more generations

under their roofs before needing replacement. Each generation then has to

replace only one-fifteenth of its housing, and expenditures on housing are

90% less than what they would be if new homes had to be built for each generation.

Housing that lasts 400 years costs only a fraction more to build. In addition

to dramatically lowering economic costs, its long life makes feasible the

generosity of design that separates our shabby "low-cost" housing

from ample, comfortable, and livable homes.

During the "Dark Ages" in Europe, people built solid and comfortable

houses, which are still in use today. Not having to replace their homes

freed the labor and materials to build their soaring and beautiful cathedrals.

Those Gothic cathedrals have already served more than 24 generations in

their 800 years of use. Although the initial effort of their construction

was great, their cost per generation has been far less than our shabbiest

construction today, and they stand as a powerful challenge to our tradition

of "economic" thinking.

Although durable construction costs somewhat more initially, it costs less

in the long run. Clay tile, slate, lead, and a few other roofing materials,

for example, have a several-hundred year life, compared to 20 years for

standard asphalt shingles. The initial cost of a tile roof is about two

and one-half times that of asphalt shingles. But the repeated replacement

necessary for the shingle roof boosts its economic cost over 200 years to

four times that of clay tile. Over 300 years, shingles would cost six times

as much as tile, and over 400 years, eight times as much as the lifetime

roof! Actually increasing our economic expenditures on construction

is to our advantage where it increases the durability and therefore the

long-term economic benefit of the building.

The value of housing durability means more than just "build to last."

It shows the importance of looking at how we lose as well as how

we build housing. War, fires, changes in land-use patterns, tax policies

that result in neglect and abandonment of housing are as important "loss-makers"

as is poor construction. And the savings involved in reuse of housing underscores

the high economic burden of additional housing required by population growth

and relocation.

SCARCITY

From an economic viewpoint, there is a fundamental difference between the

cost of new and older housing. For an older house, the economic cost has

been largely paid, and what remains is only the cost of operation and maintenance

needed to keep it habitable and comfortable. For a new house the economic

cost is the full cost of construction. The price of used houses should therefore

be far less than for new ones, and this has been true when there has been

a surplus rather than a scarcity of housing available. Today, however, the

opposite is true, with the monetary price of used houses paralleling that

of new ones because of a combination of real and artificial scarcity.

Real scarcity arises from a growing population and the natural shortages

of preferable climate and living conditions. Artificial scarcity stems largely

from institutional pressures on the housing market - from finance structures

and government monetary and tax policies. The situation is similar to that

in the oil industry. When supplies are plentiful compared to demand, a buyer's

market exists, and the price tends to fall toward the real economic costs

of producing the oil. In a seller's market, where demand is greater than

what is being produced, the sellers can soak the market for all it will

bear. In such situations, prices have no relation to the actual costs of

existing oil or housing supplies. They are limited only by the cost of available

alternatives - alternative energy sources and conservation on the one hand

and the economic cost of new housing on the other.

Although both economic and monetary costs are usually affected by pressures

on the housing market, they are differently susceptible to the influence

of public policies. Population growth, for example, may cause protracted

housing shortages, resulting in scarcity prices. Such price increases are

monetary, not economic, and can be reversed through proper expansion

of the housing supply. Public policies can assist this expansion of housing

supply.

As the housing supply expands, it shifts toward a dominance of new housing,

raising the average economic cost of the housing supply. These increased

costs are real economic costs, and they take a generation to be absorbed

and eliminated. Public policies can have little impact on this process,

other than to create a housing surplus to ensure that prices drop as economic

costs are absorbed. Population growth also interacts with limited factors

of favorable location, climate, scenic and cultural conditions, thereby

generating more competition for housing and increases in the monetary cost

of housing in such locations. Such increases are generally permanent and

largely irreversible.

Our building industry hasn't been able to prevent or eliminate housing scarcities,

largely because of government tax and monetary policies and the nature of

our financing structures. Most other major industries have become concentrated

in a few firms that have their own consumer-finance divisions and that finance

their growth and operations internally through retained profits. In contrast,

the housing industry has remained decentralized and dependent upon bank-mortgage

financing, which bears the brunt of government monetary policies.

Monetary policies that rely on manipulation of interest rates to control

the economy have little effect upon internally financed industries. They

do, however, have a disproportionate impact on the housing industry, causing

periodic massive curtailments of its output. When the money is available,

the industry doesn't have the capacity to meet the demand, and when it has

the capacity, people can't get mortgage money.

Keeping these ideas in mind, let's now look at how we can reduce - or

avoid the need for - each of our expenditures for housing.

1 - Eliminating finance costs: No-interest revolving loan funds

A no-interest state-wide revolving loan fund for housing can, in

one stroke, reduce the total purchase cost of a home by 65% to 75%.

Finance costs are by far the biggest single factor in what consumers pay

for housing, amounting to 65% to 80% of the actual price paid. The average

house is bought and sold, mortgaged and remortgaged, every eight years.

Instead of being free to its users after a century of use, the house costs

its new occupants several times as much as the original sales price, and

has cost its users 10 to 12 times its total economic cost in continued finance

charges over that period.

Our present home-financing concepts are an outdated and unaffordable legacy

from a time of low interest rates, few mortgages, and a housing market dominated

by existing housing and low prices. These low prices and interest rates

meant that the surcharge of finance payments were also not large. But with

today's population growth, scarcity housing prices, dominance of new housing

on the market, and high interest rates, the impact of finance charges upon

housing costs has become unbearable. Yesterday's justifications have become

unworkable in today's conditions.

Today virtually all housing is bought with mortgage money, and everyone

ends up paying an immense financing surcharge. We do not all need mortgage

money at the same time. So what really takes place is an equal loan of the

same money back and forth, from one of us to another, as we each

have need of it. For a necessity that virtually everyone "purchases,"

housing mortgage loans can and should be treated like the true economic

trade of time and energy they are - without a massive finance charge. It

is absurd that each and every one of us should have to pay an added financing

"tax" of up to 10 years of our labor and income. That outdated

concept triples the cost we must pay for housing.

The numerous special-interest loan-subsidy programs for veterans, the elderly,

low-income households, farmers, and others are clear testimony that our

conventional financing concepts are not considered workable today. Most

of those programs, however, consist of a continued outflow of our tax dollars

to finance institutions to underwrite their lending fees, which buyers cannot

afford. Such programs do not reduce the actual costs, but only alter which

pocket pays for it.

Operating in the normal money market has also meant that home mortgages

have had to compete with other investments whose high profits from exploitation

of people and resources set exorbitant expectations of return on investment.

The result is that we, and our housing expenditures, have been pulled into

a similarly exploitative relationship. Removal of housing finance from that

market is necessary to permit humane and sound housing decisions to be made.

A no-interest revolving loan fund recognizes that social and economic productivity,

not short-term financial "rate-of-return", are the essential measures

of the use of our housing dollars. Resources shifted into extremely durable

ways of meeting basic needs produce an unusually high level of social and

economic value. Conversion of home financing to nonprofit public operation,

as occurs with public streets, highways, water supplies, and utilities that

serve everyone, means both immense cost savings to everyone and a much more

effective use of our dollars. Removal of finance charges from housing expenditures

would also allow building costs to more closely reflect economic productivity

of more durable housing by eliminating interest surcharges on their higher

initial costs.

A revolving loan fund should operate on a state-wide basis to provide no-interest

home financing for all state residents. lt should be tax-funded rather than

bond-based, as its intention is not to secure cheaper finance money for

home buyers through the state's borrowing power, but to remove the home-purchasing

market from the high-profit finance industry.

Such funds would involve large sums of money and require several years to

build up. With a massive initial backlog of new housing demand and outstanding

loans on existing housing purchases, loans would at first be restricted

to new construction, and later extended to all other housing purchases.

Because of the cost savings to buyers, the initial emphasis on new construction

would shift purchases into new housing to expand the housing supply. As

housing vacancies eventually developed, the fund would be self-regulating.

Prices of existing houses would drop closer to their economic cost, it would

become cheaper for most people to buy existing houses rather than to build

new houses, and less use would be made of the fund. Loan repayments would

be kept as close to those of conventional mortgages as feasible within household

budget guidelines. Because of the lack of interest charges, repayment would

occur in one-half to one-third the usual time, making the funds available

more quickly for other loans.

The function of the fund would be that of an exchange mechanism,

where all state residents exchange their time/energy/money as they each

establish their housing equity. Being a revolving fund, the same dollars

would be used again and again to finance many housing purchases. The initial

taxpayer "sacrifice" would thus be minimal compared to

the benefits gained, particularly since the fund, by eliminating interest

charges, would radically lower everyone's cost of housing purchase.

Two of the largest reductions possible in housing

costs could be accomplished through this mechanism. It would remove one

of our most expensive basic necessities from massive, unnecessary finance

charges. It would make possible the stable and high level of housing

production needed to eliminate housing scarcity and scarcity prices.

And it would also eliminate the drastic impact of federal monetary policies

upon the state's housing industry by removing its mortgage financing from

the finance market so heavily burdened by federal monetary controls.

2. Reducing energy operating costs: Conservation

Inexpensive conservation can reduce energy expenditures by 75%.

The second largest hunk of housing dollars goes to energy operating costs.

Over a 50-year period, this can easily amount to $50,000-$75,000. An extra

economic cost of a few thousand dollars for superinsulation could result

in a 90% reduction in heating costs, and the new generation of small-size

fluorescent lights and more efficient appliances could similarly reduce

energy costs in these areas by 75%. Along with more durable construction,

these are prime examples of increased first cost of construction providing

major savings over the life of the house. It also underscores the importance

of dealing with financing costs, which put a massive penalty charge on such

sensible first-cost alternatives.

3. Extending economic productivity: Durability incentives

Increasing the durability of housing construction and renovation

to an anticipated life of 400 years would generate a five- to ten-fold increase

in the economic productivity of our resources put into housing. It would

correspondingly reduce the economic cost of housing by an equivalent 80%

to 90%.

The benefits of housing durability are great, but not quickly obtainable.

Their consideration is essential, however, in a period when substantial

expansion of our housing stock is occurring and when durability has

not been a central feature of our housing tradition. We must make proper

investments now if we are to reap the eventual massive benefits of durability.

Durability incentives can reduce maintenance and repair costs, stretch the

useful life of the economic work that went into the original construction

of a house, and reduce insurance expenditures.

Economic, rather than monetary, analysis should be the basis of all

housing-policy analysis. Financial analysis, through the "future-discounting"

of high interest rates, leads to ignoring the all real benefits occurring

more than 10 or 20 years in the future. This leads frequently to shortsighted

decisions with greater long-term maintenance and replacement costs.

Eliminate tax and mortgage subsidies that encourage investor-owned rental

housing and its attendant financial-based, short-term-biased decisions.

Encourage use of materials, construction methods, and detailing that contribute

to durability of housing, through research and publicity of their benefits,

code requirements, and financing and insurance premiums that reflect their

economic contributions.

Where possible, eliminate or minimize housing finance charges, which magnify

the additional cost of durable construction. (See discussion on revolving

loan funds.)

Minimize the impact of factors such as neglect, fire, demolition, or earthquakes,

which cause premature loss of housing, through preventive programs, codes,

and ordinances.

Generate a housing surplus to allow housing prices to move away from scarcity

levels down toward the actual economic cost of the housing. A revolving

loan fund can accomplish this expansion in housing supply.

4. Reduction in selling costs: Community housing exchanges

Virtual elimination of realtor's fees, through establishment of community

housing exchanges, could realize lifetime savings in housing expenditures

amounting to 25% to 50% of the sale price of a home.

Every home sale through a realtor diverts an average of 6% of the sale price

from the homeowner's pockets. With houses being bought and sold on the average

of every eight years, homeowners pay an average of six realtor's fees during

their lifetime. And if the money saved from paying the realtor's

fees was applied to reducing the mortgage on the house purchased, it could

save two to three times its amount in interest charges.

The need for realtors or other professional services has generally escaped

close scrutiny - we can reduce or eliminate the need for many

such sources by using standardized documents, new technologies, or public

education.

Multiple-listing services (MLS) have been set up in most communities by

realtors to simplify access for themselves and their clients to information

on properties available for sale. The seller fills out a card with detailed

information such as lot size, number and size of rooms, kind of heating,

tax assessment, mortgage situation, and amount of insulation. The realtor

sends the card, along with a Polaroid picture of the house, to a service

bureau. It in turn generates a computer-prepared booklet containing the

pictures and information on all the houses for sale in the

community, broken down by location, price bracket, number of bedrooms,

and so on.

The cost of a MLS is minuscule compared to the fees charged by realtors.

A normal charge to a realtor is $65 a month for the service, plus a $25

charge for each listing sold.

The technology of multiple-listing services makes most of the services that

realtors perform in the housing market unnecessary. A nonprofit MLS operated

as a community housing exchange could make such listing booklets

available to prospective buyers in libraries, post offices, shopping centers,

employment services, personnel offices of businesses, in banks, and on newsstands.

Simple guidebooks could advise both buyers and sellers what to look for,

how to evaluate a house, and how to make a fair deal. They could also include

necessary standard forms for contracts, earnest money, escrow, and land

contracts.

People would still be able to go to realtors for any special assistance

or services they wanted. But for the vast majority of sales, a community

housing exchange could perform the job for about one-thousandth the cost

of listing with a realtor.

5. Construction labor/Owner-building

Owner-building provides a reduction in the economic cost of housing

only where it makes use of human resources that would otherwise not be taken

advantage of, as with sweat-equity housing grants as part of public housing

programs. It does provide financial savings to the owner-builder

when it avoids finance charges or taxes, as well as providing social and

personal benefits.

6. Infrastructure: Reducing water, sewer, road, police, commuting, and

other costs

Our patterns of housing location, design, and use substantially affect our

community costs for utilities, roads, parks, and police, as well as our

commuting costs. Alternate sanitation, water and energy conservation, solid

waste reduction in the home, and working at home can reduce the costs of

off-site development, commuting, and community services, but these savings

are beyond the scope of this overview.

* * *

This overview has focused on ownership costs of houses, but similar costs

and savings are possible in other sectors of the housing market. Additionally,

in the rental market, separation of economic and financial analysis has

developed the logic for change in mortgage regulations that would give renters

ownership equity for the portion of their rent that now goes to an investor's

mortgage payments - 50% or more of most rental payments.

The changes we've discussed make possible immediate reductions of 75% in

the cost of housing purchase and ownership, and eventual long-term

savings of up to 90% in the overall cost of housing for generations to come.

These changes are likely to improve, rather than sacrifice, comfort or quality,

and would release vast amounts of resources and money for other social needs.

At the same time, they forcefully document the value of rethinking our social

institutions and economic processes to remove the encrustations of financial

policies and practices that have crippled and debilitated our basic economic

systems.

Housing has taken a vital leadership role in realigning our energy thinking

and policies for a new era. It can fulfill a similarly vital role

in the revitalization of our economic system and its reorientation toward

fulfilling a greater destiny for our society.

TOM BENDER

38755 Reed Rd.

Nehalem OR 97131 USA

503-368-6294

© March 1984

tbender@nehalemtel.net